Thailand Car Market Share 2025: Chinese Brands Breach the Japanese Fortress

For decades, Thailand’s automotive landscape was predictable: a fortress of Japanese dominance. But 2025 will be remembered as the year the walls didn’t just crack—they were breached.

Amidst a brutal market contraction where Total Industry Volume (TIV) shrank by over 14% due to soaring household debt and tightened pickup truck lending, a new order emerged. While legacy giants like Toyota and Isuzu grappled with declining sales, Chinese automakers—led by BYD—defied the gravity of the wider economy.

Here is the definitive breakdown of the Thailand car market share in 2025, analyzing the fierce battle between incumbent Japanese brands and the rising Chinese challengers.

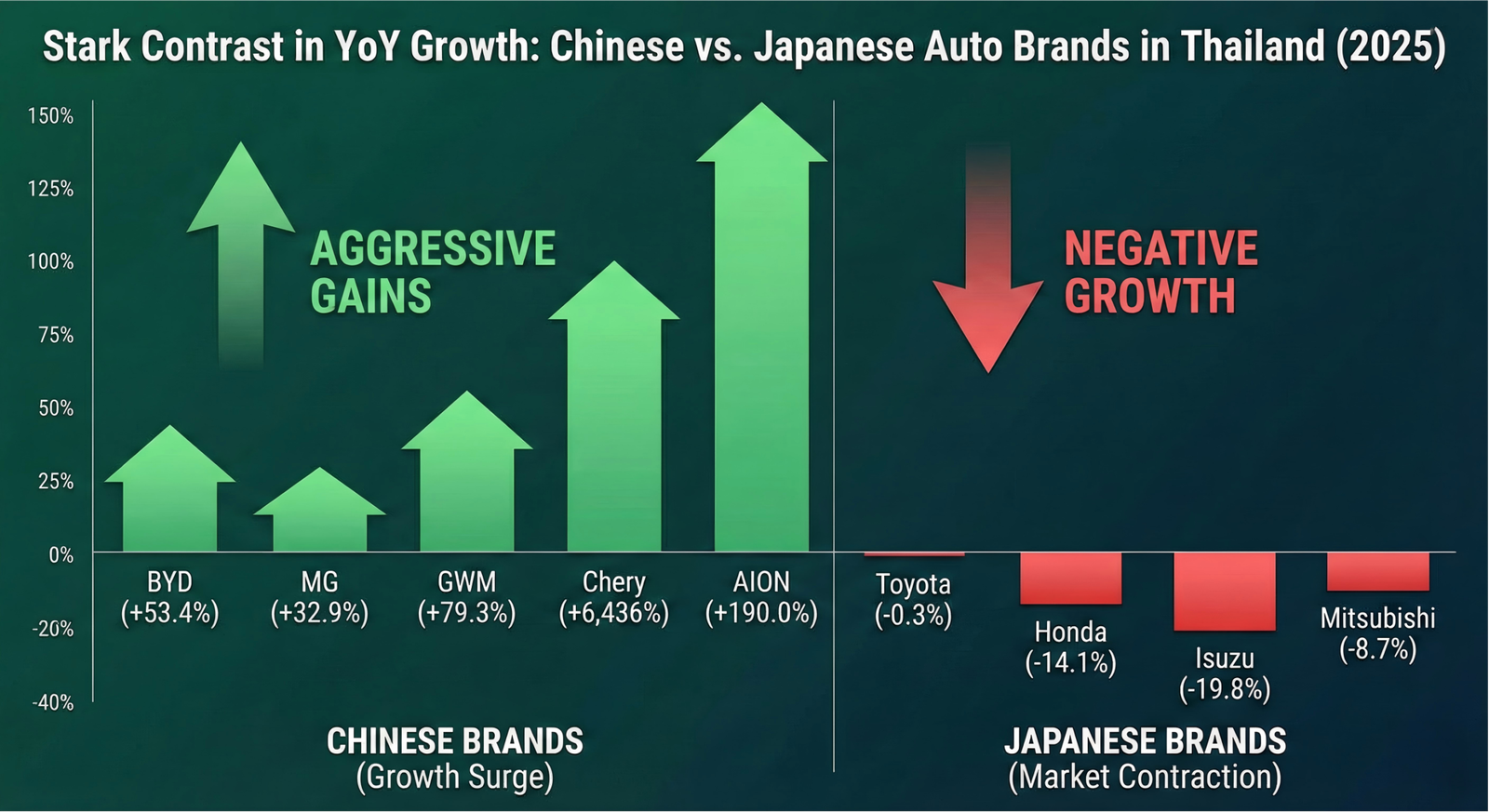

The 2025 Scoreboard: A Tale of Two Trajectories

The headline story of 2025 is the dramatic divergence in fortunes. While the overall market suffered a “hard landing” with sales dropping to around 550,000–600,000 units, Chinese brands successfully capitalized on the shift toward electrification.

According to the latest data from the Federation of Thai Industries and China Automotive Data, BYD has stormed into the Top 3, fundamentally altering the leaderboard.

| Rank | Brand | Origin | Sales (Units) | YoY Growth |

|---|---|---|---|---|

| 1 | Toyota | Japan | 169,208 | -0.3% |

| 2 | Honda | Japan | 71,510 | -14.1% |

| 3 | BYD | China | 41,180 | +53.4% |

| 4 | Isuzu | Japan | 38,838 | -19.8% |

| 5 | MG | China | 22,665 | +32.9% |

| 6 | Mitsubishi | Japan | 22,419 | -8.7% |

| 7 | Ford | USA | 18,764 | -22.6% |

| 8 | GWM | China | 14,260 | +79.3% |

| 9 | Chery | China | 12,353 | +6,436% |

| 10 | AION | China | 11,969 | +190.0% |

The data highlights a stark reality: Every Japanese brand in the Top 10 posted negative growth, while Chinese brands posted double, triple, or—in Chery’s case—quadruple-digit gains.

The “Hard Landing” for Pickups vs. The EV Boom

To understand the shift in Thailand car market share, one must look at the segment dynamics. Thailand has long been the global hub for pickup trucks, a segment traditionally ruled by Isuzu and Toyota. However, 2025 saw rejection rates for pickup loans hit 50% in some months due to high household debt. This financial squeeze devastated Isuzu, causing a near 20% drop in sales.

Conversely, the passenger vehicle (PV) segment—specifically electric vehicles (EVs)—boomed. The EV penetration rate in Thailand defied the economic gloom, breaking past 18-20%. In this electric arena, Chinese brands are not just competing; they are dominating, commanding over 80% of the pure electric market share.

Japanese Retreat: The Nissan Case Study

The erosion of Japanese market share is perhaps best illustrated by Nissan. Once a titan of the Thai market, Nissan’s 2024 sales slumped to just 16,423 units—less than a quarter of its 2018 volume.

The decline is symbolic of a broader “retreat.” Key models like the X-Trail have ceased local production. More telling is the sentiment on the ground: dealers who had partnered with Nissan for 60 years are reportedly switching allegiance, rebranding their showrooms to sell BYD. It is a microcosm of the industry-wide pivot: legacy infrastructure is being repurposed for the Chinese EV offensive.

Policy Winds: EV 3.5 and the Localization Challenge

The surge in Chinese market share is heavily supported by Thai government policy. The EV 3.0 and subsequent EV 3.5 initiatives have provided crucial subsidies and tax breaks. However, the “free lunch” era is ending.

“Starting in 2026, the ‘repayment’ phase begins. Automakers must offset imports with local production at a 1:2 ratio.”

This policy aims to cement Thailand as an EV manufacturing hub, but it also creates pressure. With aggressive capacity expansion, fears of oversupply are looming.