2026.01.21

The day when tech giants and super unicorns battle over AI hardware seems to be drawing closer.

In a recent podcast, OpenAI CEO Sam Altman revealed that the company will launch “a series of small devices.” At the Davos Forum on January 19th, OpenAI’s global affairs officer Chris Lehane further disclosed that the company plans to launch its first device in the second half of this year as scheduled. Apple has reportedly leaked plans to launch multiple new devices to “return” to the AI field, including desktop robots, cameras, and mobile robots. ByteDance’s Lark, in collaboration with Anker Innovations, launched its first AI hardware on January 19th—an AI recording bean.

Wearable AI Note-Taker

Anker AI Recording Bean

There are too many hardware forms that can be AI-enabled. They are not the AI glasses or smart speakers discussed for years, but could be a “bean,” a robot, a toy, a camera, a printer, or other things people haven’t seen before. Not only are tech giants eager to try, but a startup wave is also surging, with Shenzhen, the hub for consumer hardware, feeling this boom the earliest.

“People who didn’t look at hardware before are now looking at hardware. Many investors have directly changed their base of operations to Shenzhen. Some FAs (financial advisors) have moved their offices near DJI,” Emma, the hardware investment head of a tech-focused fund, told Yicai reporters.

Entrepreneurs with backgrounds from Shenzhen’s major hardware companies have become hot property in the eyes of investors. Some investors believe that while AI consumer hardware comes in diverse forms, the hardware forms OpenAI can find likely have already been explored by teams in China. The answers might be hidden in the business plans and demos of some startups. For robots, a major category within AI hardware, whether as whole machines or components, investment waves have surged through Shenzhen repeatedly.

Teams with Big Company Backgrounds are Favored

In the narrow valley between the southern foothills of Yangtai Mountain and Tanglang Mountain in Shenzhen, stretching along Liuxian Avenue and Metro Line 5 from Changlingpi to Xili and Liuxiandong, this area began to be called the “Robot Valley” in early 2025. If you visit robot companies in Shenzhen, there’s a high probability you’ll end up spending a lot of time here. This valley houses robot companies like RoboSense, Paxini, Unitree Robotics, Zhongqing Robot, Stardust Intelligence, and Ubtech. DJI is also located here, between Liuxiandong and Shigu subway stations.

In early 2025, reporters visited several robot companies in the area and learned that after last year’s Spring Festival, the humanoid robot concept became hot, attracting intensive research from investors. From the second half of 2025 to the present, the investment fever has gradually spread from embodied intelligence whole machines to embodied intelligence components and other AI-related hardware.

Emma told reporters that she is based in Shanghai. Over the past year, her frequency of business trips to Shenzhen has been basically once every two weeks, sometimes weekly. She often walks around near DJI, discussing projects and also talking with many teams that have spun out from DJI. One of her major focuses is AI hardware, and she also invests in other consumer hardware.

Dai Fuquan, Chairman of Banshan Venture Capital, has been focusing on companies in the embodied intelligence industry chain since last year, including components, dexterous hands, and robot brain fields. He is recently preparing to invest in a Shenzhen-based solid-state LiDAR company whose products can be used for robots. The places he visited most frequently for projects last year were Shenzhen and Hefei, with projects related to embodied intelligence mainly in and around Shenzhen. “There are many embodied intelligence supply chain enterprises around Shenzhen, and compared to other places, these enterprises are more resilient,” he told reporters.

Founding teams with backgrounds from Shenzhen’s major hardware companies are key targets for investment institutions. Emma found that in this wave of AI hardware entrepreneurship, there are many teams founded by former executives and product managers from major hardware companies. Many FAs and investment institutions are focused on digging around these founding teams.

Emma told reporters that it’s currently impossible to definitively say what type of entrepreneur is more likely to succeed. However, during the industry exploration phase, talent emerging from major hardware companies like DJI, Bambu Lab, Insta360, and Anker Innovations—which have achieved success and whose products have been market-validated—are the primary targets for institutions. These individuals are watched by investment institutions and FAs, and competition for their projects is fierce. Institutions doing sector layout like Sequoia and Hillhouse have already started broadly covering founding teams with strong big-company backgrounds, while other institutions’ strategy is to select a few promising projects.

In the eyes of investors, entrepreneurial teams from major hardware companies possess unique traits. Emma told reporters that most people coming from DJI share a commonality: a relatively extreme pursuit of product perfection. Dai Fuquan’s feeling is that people who start businesses after leaving hardware giants like Huawei and DJI have a deeper understanding of the industry. Their growth potential or probability of success is much higher than that of academic entrepreneurs. He intensively invested in many such teams several years ago. Now, as many institutions are interested in secondary shares, he is gradually exiting.

Focusing solely on DJI, there are already many founding teams in Shenzhen that originated from DJI, verifying the possibility of entrepreneurial success. The Shenzhen office of mobile energy storage unicant EcoFlow is near DJI, and its founder Wang Lei was formerly the head of DJI’s battery R&D department. The founding team of consumer-grade 3D printer leader Bambu Lab also hails from DJI. Founders like Wei Jidong of AgileX Robotics (松灵机器人), Wu Di of FJDynamics (丰疆智能), and Chen Yiqi of Zongguan Innovation (纵贯创新) also have experience working at DJI.

The exodus of talent from hardware giants is the flip side of the entrepreneurial surge. Tao Ye, founder of Bambu Lab, posted on WeChat Moments late last year, discussing the brain drain from his former employer DJI. He mentioned that the capital market has a FOMO (Fear Of Missing Out) sentiment towards the “DJI alumni,” assigning high premiums to some projects, leading to a trend of DJI employees starting their own businesses. An investor familiar with “DJI alumni” startup teams told reporters that last year, many people left DJI to start businesses. Related projects include AI imaging, toC home robots, and some vertical hardware with currently limited AI relation, such as calendars, fishing boats, etc.

Institutions Scramble for AI Hardware Projects

Including these founding teams with major hardware company backgrounds, some AI hardware projects are being fiercely competed for by institutions.

“There are many hot projects. For the hottest ones, if an institution didn’t get in during the first round of financing, they keep hoping to join later. Some companies have raised four or five rounds continuously when the team was just formed and the product was still at the idea stage,” Emma told reporters. She noted that some early-stage projects in the market, without significant changes in their development stage, continuously undergo multiple rounds of financing while their valuations keep rising. Some valuations quickly exceed $100 million, driven by market sentiment.

Some investors told reporters that valuations for certain early-stage projects like AI rings and AI imaging exceed $100 million. Emma told reporters that her team invested in a Shenzhen hardware project last July. This project wasn’t using AI at the time but had plans to do so. When preparing to invest, seven or eight institutions were competing for a share. She found that very hot projects revolved around DIY manufacturing projects like CNC (Computer Numerical Control) and 3D printing, wearable hardware, AI imaging products, etc. Institutions are all watching the amounts raised by some crowdfunding projects; for those with good results, company valuation data might multiply several times before and after the crowdfunding.

“Since last year, institutions’ valuation logic for hardware has changed significantly compared to previous years. Coupled with a relatively hot market, the valuations of many early-stage projects in their first or second rounds can already match the valuations of some projects in the past at the product development completion stage,” Emma said, adding that institutions also have relatively high tolerance for new entrepreneurs and new entrepreneurial directions.

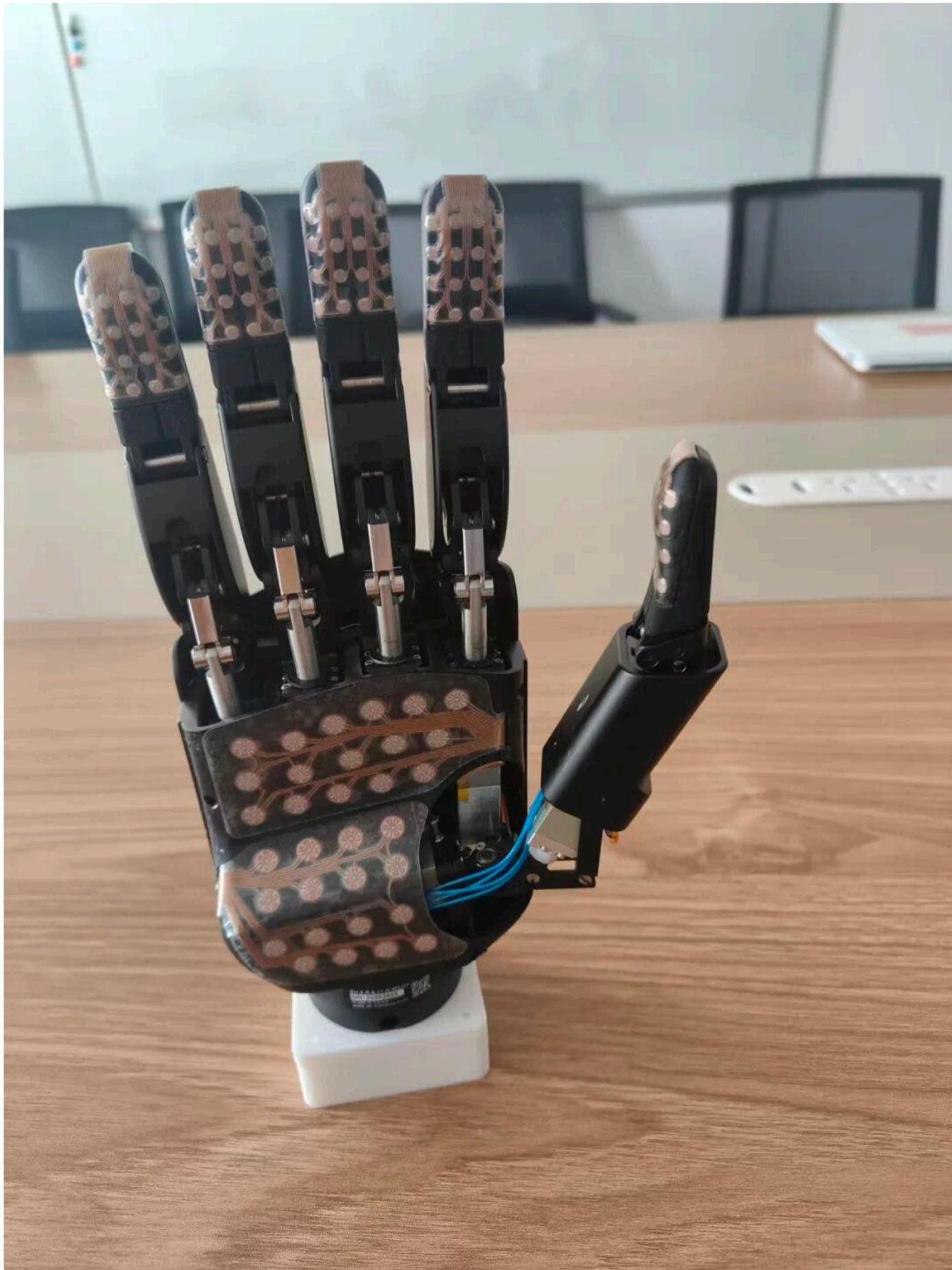

In the field of embodied intelligence components, Dai Fuquan also feels intense competition. “Before September last year, large funds focused on embodied intelligence were concentrated in the whole machine field, such as humanoid robots and robotic dogs. After September, more funds flowed into embodied intelligence components,” Dai Fuquan told reporters. After October last year, many embodied intelligence component projects were still in the preparation stage, but shares for seed rounds, angel rounds, and Series A rounds had already been allocated. Investors signed agreements in turn, and companies changed their equity structure sequentially. “When we invested in a Shenzhen dexterous hand project, we had to compete with many large institutions for shares. Competitors included industrial capital platforms, well-known investment banks, and state-owned platforms. To get in, before the final decision was even made, we held an overnight investment committee meeting ourselves, transferred several million RMB to the company’s account first to help alleviate cash flow tension. This money served as an investment sincerity deposit to secure some shares during the financing,” Dai Fuquan told reporters.

More investment institutions are noticing that the AI investment trend has shifted from software to hardware.

Wang Xinyu, partner at Meituan Longzhu, stated at the China Private Equity Investment Conference that Meituan Longzhu had invested in more than ten startups in the AI application field. They found that starting from the second half of 2025, the domestic trend shifted, with more institutions investing in hardware.

Huang Yungang, managing partner of Source Code Partners, had a similar feeling. He said that after the emergence of Manus in early 2025, there was a lack of particularly hot AI software applications, while many robot project names could be listed. He recalled feeling “apprehensive” when investing in Unitree several years ago because its valuation had already reached 2-3 billion RMB, but now it seems that investment was very worthwhile. “Simply put, robots are converging much faster, but AI applications seem to be developing slower.”

“In February 2023, I took two colleagues on a trip to Silicon Valley. At that time, everyone in Silicon Valley was talking about large models, and some talked about AI applications, but whether it was VCs or entrepreneurs, almost no one talked about robots. Returning to China, large models also had a wave of heat, but (in comparison) there were far fewer AI applications. Instead, there were too many entrepreneurs in robotics and consumer hardware, which are also called AI hardware,” Huang Yungang said. He noted that there are many teams and investments related to AI hardware in China, while in the US, it’s comparatively less.

A co-founder of a Shenzhen 3D printing manufacturer also told reporters that more and more hardware-related events are being held in Shenzhen. Since the second half of last year, investors have been very interested in Shenzhen hardware companies. The strong performance in the capital market of several listed consumer hardware segment leaders previously is also a reason for the heightened enthusiasm for consumer hardware in the primary market.

What is the Next Generation of AI Hardware?

What kind of AI hardware projects are attracting investor attention? What are these companies doing?

AI toys or pets are one representative category. “Just in the Greater Bay Area, we’ve seen 8~10 startup teams making similar products. About 90% of the various components for AI toys can be purchased around Shenzhen, where the mechanical and electronic circuit industries are concentrated,” Hu Chenhui, CEO of AI doll manufacturer Meijing Technology, previously told reporters.

Yueran Innovation, which launched AI toy products relatively early in China, has its office in Nanshan District, Shenzhen. The company secured a 200 million RMB Series A round in August last year from funds under CICC Capital, Sequoia Capital China, etc. Its two product series have sold over 300,000 units. Furthermore, supply chain manufacturers told reporters that more AI toy manufacturers will begin mass production this year.

△ AI Toys

Upstream component manufacturers, on the one hand, are feeling the growth in downstream AI hardware shipments, and on the other hand, are attracting attention from investment institutions. As upstream suppliers for AI hardware and embodied intelligence, several Shenzhen-based tactile sensor startups adopting different technical routes received new financing after the second half of 2025, including Paxini, Daimeng Robot, and Sense Technology.

Xiong Gengchao, co-founder and CEO of Sense Technology, told reporters that among downstream applications, shipments for AI pets and companion AI hardware are growing rapidly. The company has started small-batch supply for such clients. According to feedback from cooperative clients, their related product market shipments this year are expected to reach several hundred thousand units each.

“Exploration into the integration of tactile sensing and AI was still in the minority in the industry two years ago. Now, this technical direction has become an industry consensus. After integration, AI pets and companion hardware can accurately capture users’ touch force, stroking actions, and provide differentiated interactive feedback, making the interaction warmer and more realistic,” Xiong Gengchao told reporters. In the past, vision technology dominated industrial applications. Now, whether serving humans or becoming human companions, hardware devices need to possess multi-sensory capabilities closer to humans. Tactile sensing has also shifted from an optional feature to a must-have for smart hardware.

Some hardware that previously didn’t utilize AI capabilities is now being “rebuilt” with AI, hoping to capture a larger market. Among 3D printing manufacturers, Bambu Lab and Creality have integrated capabilities from Tencent’s Hunyuan 3D large model. Some 3D printing manufacturers are already envisioning a future where ordinary users can also use large models to design models originally only creatable by professionals and print them directly. Among 3D printing manufacturers, Fast Lab and Zhiyuanpai (智能派) completed financing rounds of several hundred million RMB at the end of last year.

Emma, on the other hand, notes the new possibilities AI brings to consumer hardware. “Originally, our interaction with phones, computers, etc., was basically physical contact. Once we can communicate through natural language, it lowers the hardware usage barrier and has the opportunity to expand the user base. Additionally, when AI has memory, the AI hardware experience can be tailored to each individual. This adds ‘user retention’ to the logic institutions use to evaluate hardware projects,” Emma told reporters. In the past, hardware manufacturers just sold hardware. But with differentiated software experiences, when an AI hardware’s retention rate improves, there is room to charge software service fees, changing the hardware business model.

Specifically regarding popular AI hardware categories, Emma told reporters she focuses on several major directions, including the integration of AI with imaging, companion hardware, and sports hardware. The integration of AI with imaging further subdivides into niches like watching sports, birdwatching, and stargazing. The combination of AI and sports can allow the process of exercise to be recorded and shared, and also let AI serve as a coach.

Other investors also told reporters that besides the recording bean jointly launched by Lark and Anker Innovations, there are also projects in the market working on AI recording pens and recording notebooks.

“The hardware forms OpenAI can find should also have domestic teams attempting,” Emma told reporters.

But what form the next popular AI hardware will take currently has no answer. Wang Xinyu said he has two answers: one is embodied intelligence, and the other answer is not yet clear—it could be headphones, wristbands, rings, or any other hardware powered by AI.

Amid the investment frenzy, some investors have also noticed that the concept of AI is being used too broadly and generically.

Wang Xinyu stated that some consumer hardware projects forcing themselves to align with the AI concept seems far-fetched. “Combining Chinese companies’ efficiency, supply chain capabilities with AI might ultimately lead to product globalization. AI is one capability, but not everything.”

“As long as it’s powered and has data, it’s called having intelligence; having intelligence is called smart hardware. I also don’t know why making an alarm clock can be called smart hardware, making a photo frame is also called smart hardware, and some even make smart socks, saying sensors are inside,” Huang Yungang said. Emma told reporters there is a certain bubble in the AI hardware heat. Some projects add AI for the sake of AI, generating no value and unable to withstand scrutiny. It still depends on whether AI as a variable can become the core value of the product. Dai Fuquan predicts that the heat in fields related to embodied intelligence should plateau or decline this year. On one hand, some industry funds have basically completed their layouts. On the other hand, it generally takes three to five years from the start of primary market frenzy for an industry to truly achieve commercialization. One or two years have already passed, leaving another two or three years to verify these companies’ capabilities. Startups will also begin to undergo consolidation.