Shenzhen Parts Giant Worth 55 Billion Sees Robot Orders Soar

Word Count: 2009 | Estimated Reading Time: 3 minutes

By | Yang Song, Yan Ziwei Edited By | Yan Ziwei

Building Team Cohesion, Preparing for Acquisitions.

A major precision manufacturing company in Shenzhen is capitalizing on the humanoid robot boom.

On February 8, Chen Qixing, the controlling shareholder of Shenzhen Everwin Precision Technology Co., Ltd. (Everwin Precision), held an online meeting with 27 institutional investors, announcing that the company will deliver approximately 690,000 humanoid robot precision components in 2025, generating RMB 100 million in revenue.

“In terms of per-unit value and the number of mass-produced part numbers, we are a core supplier,” the company stated.

Chairman Chen Qixing started his career in consumer electronics contract manufacturing, riding Apple’s rapid growth to achieve swift revenue expansion. Leveraging precision manufacturing capabilities, he has led the company’s transformation into the new energy and humanoid robot sectors, building a publicly listed firm with a market capitalization of approximately RMB 55 billion.

—Cited from Century Business Review

| Item | Current Fiscal Year | Prior Year Period |

|---|---|---|

| Net Profit Attributable to Shareholders | 54,500~63,500 | 77,152.95 |

| YoY Change: -29.36%~-17.70% | ||

| Net Profit After Extraordinary Gains/Losses | 51,500~60,500 | 53,114.47 |

| YoY Change: -3.04%~+13.90% | ||

| Unit: RMB 10,000 |

“Consumer electronics business has stabilized, while new energy business continues to grow.” Everwin Precision forecasts its 2025 net profit (excluding extraordinary items) to be between RMB 515 million and RMB 605 million, showing improvement.

The humanoid robot business is emerging as a key player. Management stated that the market has enormous potential and hopes this segment will become the third pillar of growth.

Cultivating New Growth Pillars

Chen Qixing, 67, holds an associate degree and hails from Anqing, Anhui Province. He worked at a local woolen mill before moving to Shenzhen, where he founded Everwin Precision in 2001.

He owns 29.6% of Everwin Precision, worth over RMB 16 billion based on the closing price on February 9.

Everwin Precision A-Share Real-Time Quote – Baidu Stock

¥40.35 +0.03 (+0.07%)

Closed at 15:30:00, Feb 9 (Beijing Time)

| Open | 41.60 | High | 41.62 | Volume | 632.3K lots |

|---|---|---|---|---|---|

| Prev Close | 40.32 | Low | 40.12 | Turnover | RMB 2.566B |

| Turnover Rate | 4.66% | P/E (TTM) | 85.10 | Market Cap | RMB 54.912B |

The company focuses on “excelling at its core competency,” avoiding robot assembly to specialize in components.

“We started with ultra-precision small parts and gradually expanded to high-value large components.”

Management emphasized that Everwin Precision offers integrated metal and non-metal processing capabilities, providing end-to-end services for humanoid robot clients while optimizing designs and proposing cost-saving solutions.

Its products focus on transmission components, initially centered on dexterous hands but now expanding to large-size categories, with over 400 part numbers supplied to clients.

The team is currently developing a new product: “force-controlled joint modules.”

Existing force-controlled arms in the industry typically use current-loop solutions (calculated force, not measured). Everwin’s solution incorporates torque sensors to capture true force data, enabling compliant interaction.

In early February, Board Secretary Hu Yulong stated that force-control products had undergone multiple sampling and testing phases, with clients visiting production lines.

Everwin also leverages customer relationships: “Our earliest partnerships were with overseas brands, which still account for the bulk of shipments.”

In September, Chen Qixing noted that most humanoid robot clients come from automotive and tech sectors—industries where Everwin was already a supplier.

In 2025, overseas clients contributed nearly 80% of the 690,000-unit shipments. Two overseas clients alone generated RMB 35 million in H1 revenue—over 3x 2024’s figure.

Chen has also secured domestic orders and is rapidly expanding capacity.

The Everwin Precision Robot Intelligent Manufacturing Industrial Park in Songgang, Shenzhen, became operational in Q4 2025. Approximately 60,000 sqm of its facility is dedicated to humanoid robot production.

Expansion Through Acquisitions

The humanoid robot industry lacks standard parts. Clients customize requirements for joints, motors, reducers, etc.

Building on precision machining capabilities, Everwin is investing broadly to offer one-stop solutions for assembly clients.

Metal Bipolar Plate – Stainless Steel Cooling Plate

Material: Stainless Steel | Process: Stamping, Welding

Charging Gun – Single Port

Material: Composite | Process: Injection Molding, Assembly

New Energy Components Business

“Strengthen AI-related product lines and invest in core components,” Chen directed in early 2025.

The company injected RMB 50 million into its wholly-owned subsidiary Everwin Robotics and took stakes in reducer and motor manufacturers.

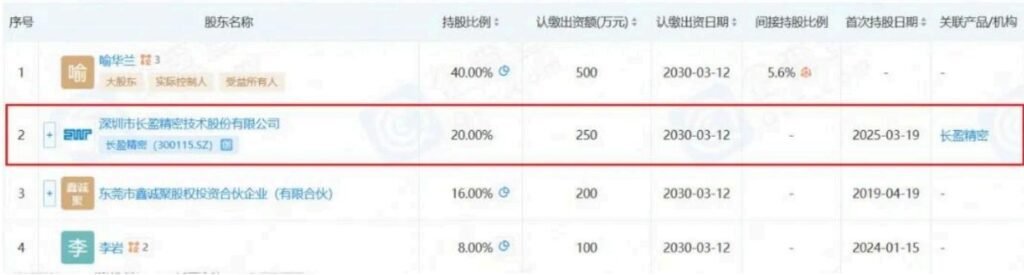

In February 2025, Everwin invested RMB 2.5 million in Dongguan Guosenke Precision Industry Co., Ltd., acquiring a 20% stake. Guosenke specializes in harmonic reducers—a core component of humanoid robot joints.

- Unified Social Credit Code: 91441900MA51DK7B75

- Legal Representative: Yu Hualan | 3 Affiliated Companies

- Registered Capital: RMB 12.5 million

- Founded: March 13, 2018

- Profile: Dongguan Guosenke Precision Industry Co., Ltd. was founded in March 2018. Its business covers R&D and sales of general machinery, robots, and precision industrial equipment…

- Phone: 13714735156

- Email: yuhualan@guosenke.com

- Address: Room 101, Building 1, No. 33 Tangjiao Garden Xincun Street, Chashan Town, Dongguan, Guangdong

Industry (Qichacha): Industrial Robot Manufacturing Scale: Small Employees: 36 (2024) Revenue: (2024)

Previously, Chen had focused on robot joint structural parts (e.g., dexterous hand modules, limb joints) but lacked core transmission technology. The Guosenke investment integrates harmonic reducer R&D/production to support high-precision joint modules.

In April 2025, Chen approved the acquisition of 51% of Weixianke for RMB 102 million.

Tianji Weixianke’s flagship products are high-speed cables for industrial robots, security systems, and AI servers.

“Key technical personnel at the target company have over a decade of experience in server high-speed cables.”

Management added that it has begun mass-producing liquid-cooling shunts and quick connectors in collaboration with Taiwanese partners.

Building Team Cohesion

To Chen’s team, Everwin’s core strength lies in its experienced engineers.

“We started with precision molds. Our mold department has over 2,000 employees, including ~500 senior engineers with 15+ years of experience and 1,000+ with over 10 years.”

Management explained that applying precision mold processing expertise to robot components results in “high yield rates and satisfied customers.”

Retaining technical talent is attributed to Chen’s generous stock option grants.

For example, on January 23, Everwin launched a new incentive plan, granting 14.26 million stock options to 870 employees—including key staff in Vietnam, the U.S., and Singapore.

If performance targets are met, these employees can purchase shares at ¥36.47/share in phases.

No upfront payment is required. Employees may forfeit options if the share price falls below the exercise price. Based on the Feb 9 closing price, profit per share is nearly ¥4.

For executives, Chen’s incentives emphasize long-term alignment and shared risk.

His leadership team includes five “managers”:

- Chen Xiaoshuo (45), General Manager (Southeast University graduate);

- Zhong Fazhi, Deputy GM (senior mold engineer);

- Hu Yulong (38), Board Secretary (Sun Yat-sen University graduate)…

| Holder | Position | Planned Allocation (Shares) | % of Total Plan |

|---|---|---|---|

| Chen Xiaoshuo | General Manager | 3,248,520 | 5.41% |

| Li Yingyue | Deputy GM | 2,467,230 | 4.11% |

| Lai Xuchun | Deputy GM | 2,467,230 | 4.11% |

| Zhu Shouli | CFO | 2,056,020 | 3.43% |

| Hu Yulong | Board Secretary | 2,056,020 | 3.43% |

| Zhong Fazhi | Deputy GM | 2,056,020 | 3.43% |

| Tian Gang | Deputy GM | 2,056,020 | 3.43% |

| Xu Dahai | Employee Director | 1,233,620 | 2.06% |

| Mid-level Mgmt & Tech/Biz Staff (≤23 persons) | 42,354,320 | 70.60% | |

| Total (≤31 persons) | 59,995,000 | 100.00% |

In early 2025, Chen launched the 6th Employee Stock Ownership Plan, allowing 31 managers to buy up to 2.918 million shares at ¥20.56/share. As of Feb 9, they held paper gains of ~RMB 58 million.

Executives loyal to Chen have profited. At the end of 2025, Chen Xiaoshuo and four other executives planned to sell 380,000 shares for ~RMB 15 million, citing personal liquidity needs.

With the robot parts business at a critical scaling phase, rewarding employees now fosters unity to seize opportunities.

Title Image Source: Visual China Image Source: Everwin Precision (unless noted) </paper> [File Content End]

Note:

- Financial figures in tables are in RMB 10,000 (万元).

- Stock prices/trading data are from February 9, 2025.

- All named individuals, companies, and products retain their original transliterations.

- Repeated sections in the original document were translated once.