Humanoid Robotics Production Accelerates

Recent Omdia data reveals Chinese dominance in 2025 humanoid robot shipments: AGIBOT leads with 5,168 units, followed by Unitree (4,200 units) and Ubtech (1,000 units). Unitree later clarified its actual shipments exceeded 5,500 units, claiming the top position.

Meanwhile, Elon Musk stated Optimus could handle complex tasks by late 2026, with public sales expected in 2027. This positions Chinese firms at the forefront of scaled humanoid production – a boon for supply chain players like Shenzhen-based Everwin Precision (300115.SZ).

Everwin Precision: From Components to Robotics

Founded in 2001 as “Shenzhen Furuikang Precision,” Everwin initially focused on consumer electronics components. Key milestones:

- 2003: Expanded into mobile device structural parts (Samsung, Motorola, ZTE)

- 2010: Listed on Shenzhen Stock Exchange

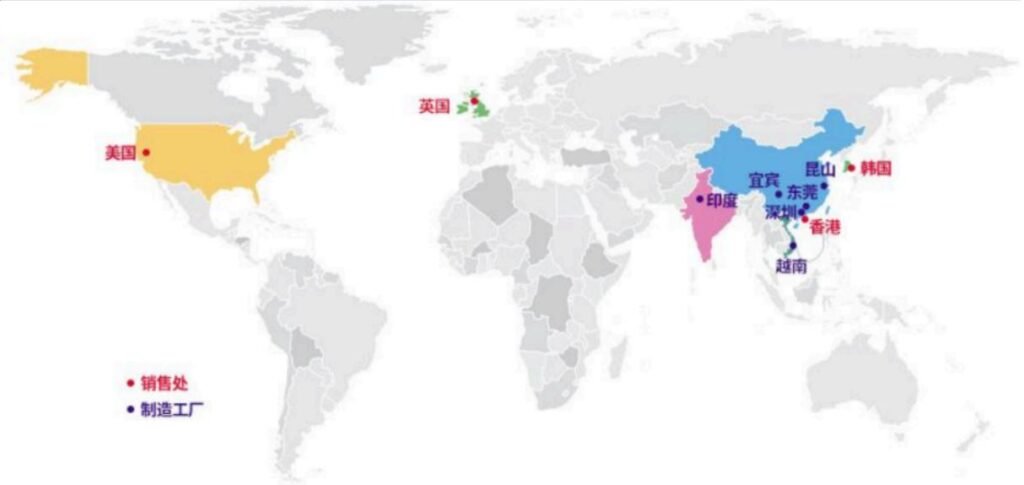

- 2012-2016: Global expansion with subsidiaries in US, Hong Kong, Korea; acquired 51% of Guangdong Fangzhen (waterproof materials)

- 2019-2020: Established India subsidiary; launched Vietnam production base

The company is now transitioning from precision manufacturing to smart systems, targeting humanoid robotics and AI servers.

Twin Pillars: Consumer Electronics & New Energy

Consumer Electronics

Despite 2025 market headwinds (slowing growth, trade tariffs), structural opportunities exist:

- Apple: Supplies MacBook metal casings (since 2018), iPad keyboards, and Apple Watch components. AI integration in MacBooks drives demand.

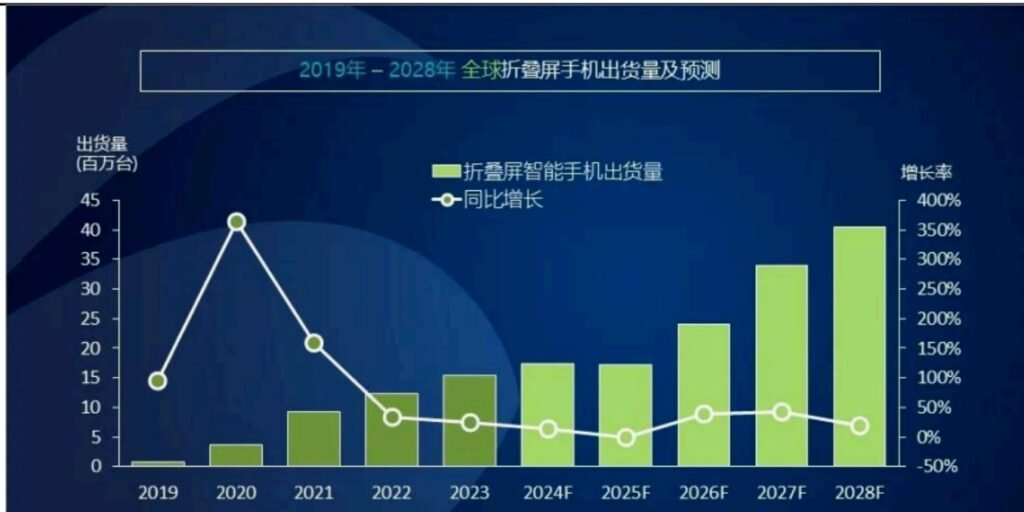

- Android: Rising foldable phone shipments (Huawei, Samsung) boost titanium frame demand – an area where Everwin holds expertise.

New Energy

Partners include Daimler Benz, CATL, and Tesla (supplied high-voltage connectors for Model 3 via subsidiary Suzhou Kelunte).

Financial Snapshot (2025 Jan-Sept):

| Metric | Value (RMB) | YoY Change |

|---|---|---|

| Operating Revenue | 13.51B | +11.68% |

| Net Profit | 468M | -21.25% |

| Core Net Profit* | 443M | +19.19% |

*Excluding non-recurring items

New energy revenue grew 37.09% in H1 2025 but profitability remains pressured.

Robotics & AI: Dual Growth Engines

Humanoid Robotics

Leveraging precision manufacturing expertise, Everwin provides end-to-end component solutions:

- Established Shenzhen Everwin Robotics subsidiary (2024) producing joints, sensors, and gears

- Partners: Tesla, Figure AI

- 60,000 sqm robotics industrial park (Shenzhen) operational in Q4 2025

- Humanoid component orders: RMB 80M (Jan-Aug 2025) vs. RMB 10.11M in 2024 (+791.29%)

On rumored Unitree collaboration: “Cannot comment due to confidentiality agreements,” stated Everwin’s board secretary – a tacit confirmation.

AI Server Solutions

Acquired 51% of Shenzhen Weixianke Electronics (2025) to develop:

- High-speed backplane connectors for servers/workstations

- Copper interconnect modules for data centers/humanoids

Risks & Outlook

Challenges: Overreliance on top 5 clients (74.92% of 2024 revenue), slow robotics scaling.

Nevertheless, Everwin’s robotics orders and AI infrastructure investments position it for structural growth beyond traditional sectors.

Source: Investor disclosures, company statements. Images contain AI-generated content.